Some problem platforms are really courageous. With regular supervision, they want to do illegal operations. However, people's supervision is not vegetarian. In order to ensure the rights and interests of investors, they have to be fined illegal.I know Brother today to summarize some of the fined platforms. These platforms have already had a previous department, and everyone is cautious!Intersection

1. Fuchang Financial Group

Founded in 1999, Fuchang Finance mainly provides financial services through three subsidiary companies including Fuchang Securities, Fuchang Futures, and Fuchang Asset Management.In the same year, Fuchang Securities was awarded as a registered securities company by the Hong Kong Securities Regulatory Commission.But since 2019, Fuchang's financial income has declined compared with 2018.From the perspective of transaction data, the business scale of Fuchang Finance in Hong Kong's local securities brokerage has also declined.

According to the Hong Kong Securities Regulatory Commission, from October 2015 to March 2016, Fuchang Securities investigated and prevent illegal short -selling transactions because it did not establish effective internal monitoring procedures, resulting in at least 93 short selling transactions.

Fuchang Securities was condemned by the Hong Kong Securities Regulatory Commission and fined 3.6 million yuan due to the lack of internal surveillance involving short -selling transactions and not in accordance with the provisions of the CSRC's "Conflict Standards".

2.bdswiss

BDSWISS was founded in 2012 as a brand, and it is already a financial group today!And claiming that it provided a series of transaction tools across multiple assets is providing foreign exchange and difference contract investment services for more than one million customers worldwide.

BDSWISS violated the regulatory rules for the difference in the difference in the price of the protection of retail investors, and also conducted misleading promotional activities to the British retail investors, promised unrealistic returns, and caused huge losses to investors.

In response, Cysec Cysec fined 100,000 euros on the entity of BDSWISSHOLDINGLTD!

2021 was included in the British FCA in the United Kingdom

I also found it when I understand the details of the incident!As early as 2021, BDSWISS was announced by the FCA of the British Financial Industry Regulatory Administration, and banned the Cyprus broker BDSWISS and all its subsidiaries to provide British investors with a differential contract (CFDS) tool.

Through the punishment regulations, we learned that BDSWISS was controlled by the British FCA, but it has been operating in the UK in violation of regulations after being banned!

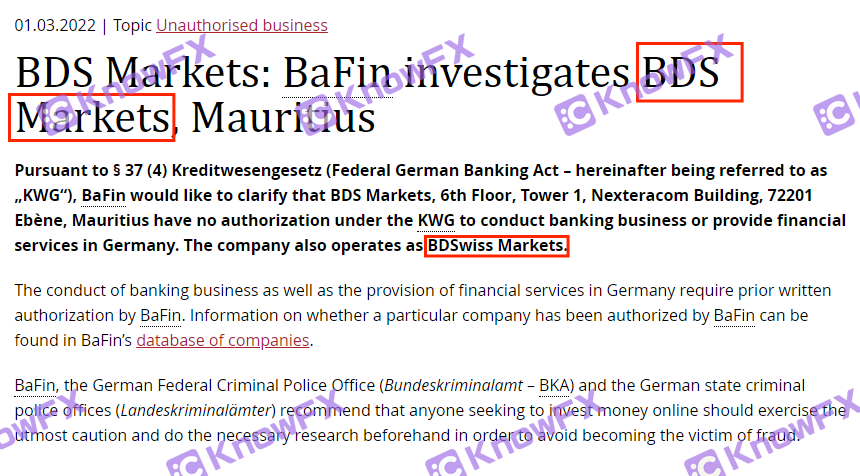

In 2022, he was investigated and notified by Bafin in Germany:

And there are more than one example of such illegal operations!

In March 2022, the German financial regulatory agency, the Federal Financial Supervision Bureau Bafin, also launched a survey on BDSWISS!According to the Regulations on the 537th (4) of the German Federal Banking Law (KWG), the broker did not authorize the bank business or provides financial services in Germany.

2016 and 2017 were punished by Cysec, Cyprus: Cyez:

BDSWISS was also revealed in Huiyou's guest complaints. In the two years of 2016 and 2017, it was suspected of violating investment service laws and activities and regulatory market law regulations for protecting customers' interest measures in 2016 and 2017!Cysec was fined 5,000 euros and 150,000 euros, totaling 155,000 euros, respectively, and a total of 155,000 euros.

It can be described as the guest of the regulatory agency!This platform understands that Brother advises everyone to stay away as soon as possible!Intersection

3. Brokerage OANDA Anda

There are three CFTC compensation cases in OANDACORPON!Intersection

CFTC ordered Toronto to pay $ 500,000 for violating capital, reporting and regulatory rules.

Specifically, OANDA failed to meet the minimum net capital requirements. When paying dividends, it violated equity withdrawal restrictions three times, failed to meet certain report requirements, and failed to carefully supervise matters related to its business as CFTC registered.

The order requires OANDA to pay a $ 500,000 civil fine and stop any more violated behavior of CFTC.

OANDA trading currency market prices and the spread of use did not reflect the real price of the market.

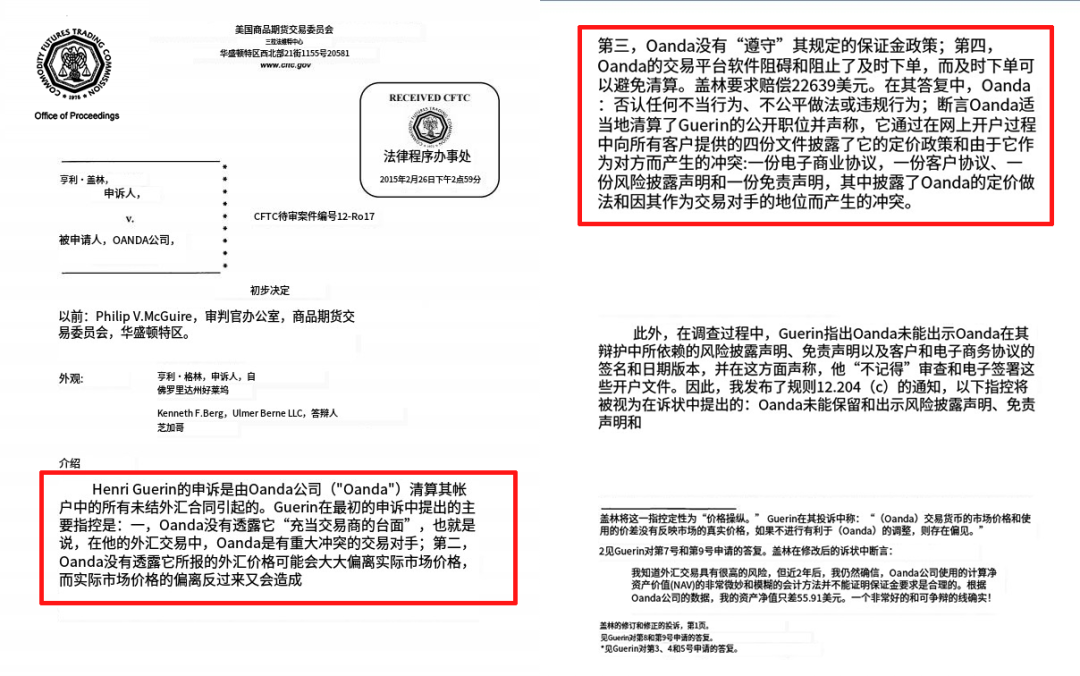

In this CFTC compensation case, Henriguerin's appeal raised the four issues of Anda as follows:

1.OANDA did not disclose it "as a countertop", that is, in his foreign exchange transactions, OANDA is a major conflict trading opponent.

2.OANDA does not disclose that its quotation may seriously deviate from the actual market price, and this deviation will cause risks.

3.oanda does not "follow" the margin policy stipulated;

4.oanda's trading platform software hinders and prevents timely ordering, and placing orders in time can avoid liquidation.

Among them, there is a CFTC compensation case. The official website of the truth brother on the US Commodity Futures Commission (CFTC) also saw it, but the detailed contents can be opened. If you want to know Huiyou, you can search for related content.Essence

It is recommended that you see some platforms or detour!IntersectionAfter all, it is already a platform for regulatory punishment. Such a platform is definitely lacking in the protection of investors!Intersection

还木有评论哦,快来抢沙发吧~